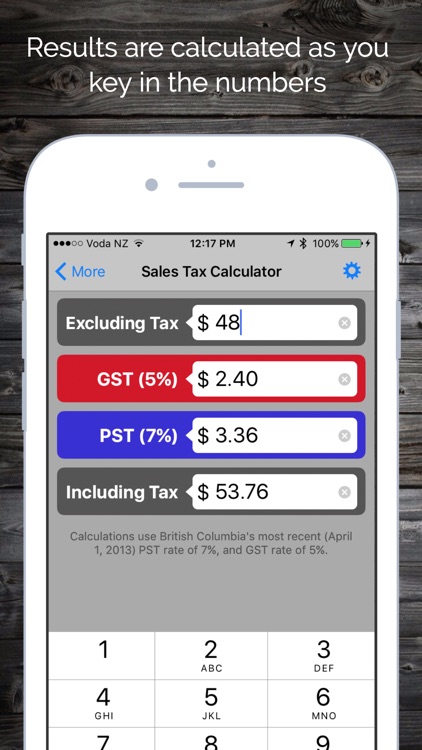

This online sales tax calculator solves multiple problems around the tax imposed on the sale of goods and services. It can calculate the gross price based on the net price and the tax rate, or work the other way around as a reverse sales tax calculator. The sales tax system in the United States is somewhat complicated as the rate is different depending on the state and the base of the tax. You can also determine sales tax by dividing the total tax you pay as a customer by the item’s price before tax. If you know the total value of the item after-tax, you can deduct the pre-tax price and subtract it from the after-tax price to determine the exact tax you pay at retail. The price of an item purchased after tax can be divided by the tax paid in decimal, calculated by converting the percentage to a decimal.

How to use the sales tax calculator

They are charged as a percentage of the sale price, and therefore are the same regardless of your income. This means that a poorer person pays a larger percent of their income. An excise tax is a tax on specific goods and services, usually those considered harmful, while a sales tax is a general tax on most things. Excise taxes can also be per unit (e.g. per bottle of alcohol), while sales taxes are always as a percentage of the item’s cost. Statewide sales taxes are collected by 45 states and the District of Columbia.

How to use the reverse sales tax calculator?

You could also potentially face criminal charges or lose your vendor license. There are taxes to be paid when purchasing a house, but they are not sales tax. Please check your local laws for more information regarding these taxes. This tool is invaluable for individuals trying to decipher the true cost of products post-tax and for businesses aiming sales tax decalculator formula to communicate pricing to customers transparently. Tibor relies on this calculator to assess the tax implications for new product launches and keep abreast of financial analytics. To demonstrate the diversity of sales taxes in the United States, you can find more details about the applied sales taxes in U.S. states in the following table.

Sales tax calculator: How to calculate your sales tax

- Rather than calculating the sales tax from the purchase amount, it’s easier to calculate the sales tax in reverse then separate this amount from the total amount.

- The following is an overview of the sales tax rates for different states.

- Some of the earlier attempts at sales tax raised a lot of problems.

- Perhaps the greatest benefit of taxation via VAT is that because taxation applies at every step of the chain of production of a good, tax evasion becomes difficult.

- If you’re selling tangible goods that are not exempt from sales tax (such as groceries), you more than likely have to collect sales tax.

On average, the impact of sales tax on Americans is about 2 percent of their personal income. Sales tax provides nearly one-third of state government revenue and is second only to the income tax in terms of importance as a source of revenue. Sales taxes are much more important in the south and west than they are in New England and the industrial Midwest. Florida, Washington, Tennessee, and Texas all generate more than 50 percent of their tax revenue from the sales tax, and several of these states raise nearly 60 percent of their tax revenue from the sales tax.

How to calculate sales tax backward from total?

If an out of state customer comes to your state to make the purchase, you can collect tax on that. You should, however, consult your local law, as your area may be different. To address this concern, American policymakers adjusted the income tax law to compensate for such an adverse effect. Taxpayers can settle a limited amount on a special saving account (for example Individual Retirement Accounts and 401(k) plans) that is not subject to taxation until they withdraw their money during retirement. In such a case, people who save through these accounts eventually taxed based on their consumption rather than their income.

Sales Tax Calculator

From there, it is a simple subtraction problem to figure out that you paid .61 cents in sales tax. When starting a business, you generally need to obtain a sales tax permit if you plan to sell taxable goods or services. Some states require registration even if you expect to have minimal sales, while others have thresholds for sales volume before registration is necessary. Check with your state’s tax authority for the exact rules and procedures for obtaining a sales tax permit. When you need to pay and file sales tax returns, it will depend on the state and your sales volume or revenue. However, most states require you to file a sales tax return and pay taxes you collect every month.

Access and download collection of free Templates to help power your productivity and performance. This free service is for illustrative purposes as-is without warranties. If you intend to rely on these rates, please utilize QuickBooks Sales Tax. Take a look at our price elasticity of demand calculator to keep reading about this subject. Today, 24 states have adopted the simplification measures in the Agreement (representing over 31 percent of the population), and more states are moving to accept the simplification measures.

The most popular type of sales tax is the retail sales tax which is present on state-level in the United States. Under such a taxation framework, consumers pay the price of the item plus the amount of the sales tax which is collected by the store at the cash register and printed on the receipt. In the next section, you can get more insight into its concept as we illustrate the difference between the sales tax and value-added tax. Strongly connected to the argument of saving behavior, tax laws which promote savings also impose more substantial weight on people with lower income.

In other words, the full price effect depends largely on the price elasticity of demand. However, even if an altered tax rate brings change in the price level, the duration of the effect is rather short and hardly induce a sustained increase in the inflation rate. In both types of taxes, the tax burden is charged on the final consumer; however, they have a different framework of collection, administration, and effects on the economy. Through a simple example, the below table illustrates the comparison between VAT and retail sales tax. Imagine a lumberjack cutting trees (without cost) who sells the wood (enough for one barrel) to a sawmill owner for $100. The sawmill owner cuts the wood into oak staves and sells it to the cooper for $150.

The due date is generally the 20th or later in the month following the reporting period. While the specific items subject to sales tax may vary from one jurisdiction to another, certain goods are commonly subjected to this tax. If you have tax rate as a percentage, divide that number by 100 to get tax rate as a decimal.

Unlike VAT (which is not imposed in the U.S.), sales tax is only enforced on retail purchases; most transactions of goods or services between businesses are not subject to sales tax. Easily calculate sales tax rates in your state with our free sales tax calculator. Simply plug in your business address and ZIP code to get your total estimated sales tax rate. The only thing to remember in our Reverse Sales Tax Calculator is that the top input field is the sales tax percentage and the bottom input field is the total purchase price.